Retail and commercial premises: Changing strategies to "overcome the storm"

The Hanoi market records an increase in the vacancy rate in commercial centers and prime locations. And for the first time, the market have witnessed lessors negotiating prices with lessees.

Changing strategies to help the market "overcome the storm"

According to the General Statistics Office, Hanoi's retail sales of goods increased by 9.9% over the same period last year thanks to the increased demand for stockpiling essentials and the boosted e-commerce. However, sales remains low due to limited imports as well as income and purchase power affected by the pandemic.

Recent data from Savills shows that about 50% of retail businesses have a revenue decline of more than 50% during and after the recent Covid-19 period. Accordingly, demand is greatly affected, retail companies and retailers cannot continue to expand their business plans.

Pressure on rent has subsided in recent months, especially with a more reasonable adjustment to support retail companies and retailers. Typically, the price of retail spaces in the central old quarter areas has decreased deeply compared to before Covid-19, the price of gold positions may decrease by 30-40% to attract customers to continue renting spaces.

Commenting on the market's reaction, Mr. Le Tuan Binh, Head of Commercial Lease, analyzed: “Lessoers will have to evaluate their rental premises in accordance with the general market level in two points. The first is the rental price . Most lessors in the old quarter have never had to negotiate with lessees. They will be the party to choose the lessee who pays the highest price. However, now the lessors in the old quarter are actively offering price options that are more suitable to the market.

Secondly, there is a need for more flexibility in terms of rental options, possibly in terms of rental spaces. In the past, lessors had very few options for renting premises, but now it is more flexible when the premises are divided into small areas, so that lessees can choose. At the same time, conditions such as the lease term and the terms of rent adjustment have been much more flexible. Although revenue has been reduced, it will be recovered quickly after the epidemic period."

Many retail spaces on the old quarter have closed because of Covid-19.

According to Mr. Binh, although in the past time, the owners of commercial centers had introduced great support policies for lessees, the number of empty booths had increased significantly.

Mr. Binh explained: “The first problem to be taken into account is the lease strategy, the business strategy of retail units has also had a certain change after the pandemic period. There are many retailers that realize the potential of the e-commerce field and have begun to gradually shift their operations to e-commerce. The physical business premises are no longer the number one priority, so commercial centers are required to adjust the lessee subjects, rental conditions, rental area, etc., to attract suitable lessees.

For example, many retail units have been affected by the pandemic recently, but Savills data shows that units such as supermarkets have high revenue of up to 20%. Supermarket premises are often preferential in terms of rent or have lower rents than other retail units because the supermarkets need to use a large rental area. The supermarkets also help to attract other retailers to co-rent the commercial centers and in fact a supermarket is a must-have utility of any commercial center or complex project. During the pandemic, people's demand for shopping for essential items in supermarkets has increased, leading to a significant increase in revenue of supermarkets."

Supermarket premises are often preferential in terms of rent or have lower rents than other retail units because supermarkets need to use s large rental area.

What scenario will happen at the end of 2020

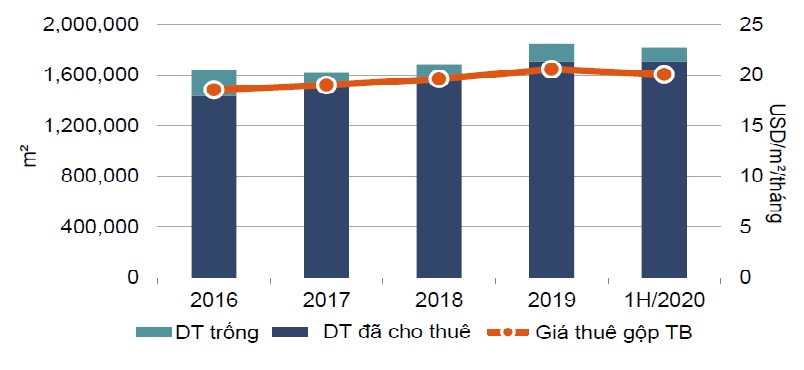

Data from Savills Vietnam's first 6 months of 2020 report shows that the pandemic reshaped the commercial rental market with new trends in Hanoi. Therefore, the old quarter retail industry needs to target more segments that have not been prioritized before, such as domestic customers, foreign residents, and different income segments. This can be considered as a way to increase support to survive and can be a push to recover later.

According to Ms. Do Thi Thu Hang, Director of Research and Consulting Department, Savills Hanoi: “For the retail market, the rental price continues to be in a downtrend. Due to the uncertainty about the evolution of the Covid-19 epidemic, it is possible that some new projects delay their opening time. The market is expanding to the East and the West region. The opportunities are still for e-commerce in the coming time.

The growth of online shopping coupled with consumer behavior rapidly changing requires brick-and-mortar retailers and lessors to develop more innovative strategies to attract lessees. Studying retail sales over the years, it can be seen that major impacts such as the global financial crisis or Covid-19 are only short-term. The market will gradually recover later.”

In addition, the decision to lease new premises will almost only happen in late 2020 or early 2021 when the market is clearer about the possibility of recovery. For now, retailers will focus on renegotiating with lessors about rental conditions as well as support options. After the new normal period, retail premises face a great opportunity to self-adjust market indexes such as rents, supply and demand, etc. Especially, this is an opportunity for retailers to approach to gold positions that have never been offered in the market before at a more reasonable price.

By the end of 2021, the Hanoi market will record 19 new retail projects with a total area of about 195,000 m2, of which 43% are in the western area and 28% in the secondary areas.