Office rents increase despite the epidemic

The average offer price of Grade B office spaces in Ho Chi Minh City increased sharply in the third quarter, while that of Hanoi only decreased by 1% over the same period last year.

The average offer price of Grade B office spaces in Ho Chi Minh City increased sharply in the third quarter, while that of Hanoi only decreased by 1% over the same period last year.

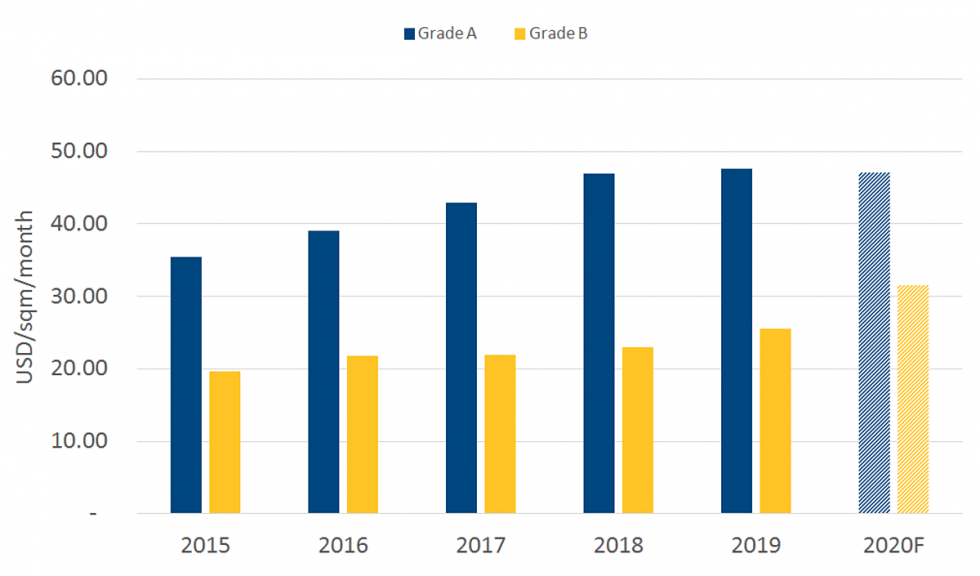

The Ho Chi Minh City Office Market Report in the third quarter of 2020 of Colliers International Vietnam showed that the average offer price of Grade A and B offices in the third quarter increased by 4.5% and 11.5% respectively compared to the second quarter.

Compared to the same period in 2019, Grade A office offer rental price only decreased slightly by 0.2%, while Grade B office one increased sharply by 26.1%. Accordingly, the net rental price range of Grade B buildings in Ho Chi Minh City was very wide, ranging from about 10 to 48 USD per m2 per month as of the third quarter of 2020.

Due to the absence of new supply in the second quarter, the occupancy rate of Grade A and B offices in the last quarter increased approaching to the peak. Specifically, the vacancy rental area of Grade A and B was 2% and 5% respectively.

Similarly, the rents in Hanoi was only behind Singapore (in ASEAN), down only 1% over the same period last year, and the occupancy rate reached 94%. According to Le Tuan Binh, Head of Commercial Lease Depatment of Savills Hanoi, this was a good sign that the office market here had great potential for recovery after Covid-19 was under control.

An office brokerage company in Hanoi said that currently, the rental price of some Grade A offices ranged from 26-45 USD per square meter in Ba Dinh Sistrict, 22-30 USD per square meter in Dong Da District and 27-46 USD per square meter in Hoan Kiem District.

Central area of Ho Chi Minh City with some Grade B office buildings in the photos such as: Saigon Trade Center, Vincom Center, The Landmark Tower, etc. Photo: Quynh Tran.

Explaining the fact that Grade B offices in Ho Chi Minh City have become the most sought segment in recent times, Colliers International believes that because of the consequences of Covid-19 along with the trend of moving out of the center and it is preferred by most small and medium businesses.

Specifically, during the epidemic, the rents of Grade A offices keep increasing, so some companies start to move their offices out of the central area to reduce costs. New districts that have received attention include District 2, Distrct 5, Binh Thanh and Tan Binh districts.

In addition, some large tenants move from Grade A buildings to Grade B ones, even the goal is to find buildings with lower rental costs. The banking, finance and technology industries have begun to shrink the lease area because they want to restructure their offices to reduce costs.

Mr. David M. Jackson, General Director of Colliers International Vietnam, said that Grade B offices were highly appreciated for their quality and central locations, but the prices were much more affordable than Grade A offices. "Therefore, this is the segment that will be most popular, dominating both market demand and supply in the near future," he forecast.

In Hanoi, Savills also said that in the second quarter, many tenants accepted to narrow their office spaces or move to commercial premises with lower rents to control costs. Savills recognizes the trend of transitioning from a traditional office to a flexible serviced office. This form helps tenants save up to 90% of costs.

Average monthly offer price per square meter of Grade A (blue) and Grade B (yellow) office space in HO Chi Minh City over the years. Source: Colliers International.

In fact, there are still tenants with good financial capacity moving their offices to Grade A buildings, but the transaction volume is much less than the same period. Due to the unchanged supply, occupancy rate this quarter remains high.

If the epidemic is well controlled, new supply in the eastern districts of Ho Chi Minh City is deployed, foreign investors will move into Vietnam. At that time, the demand for office spaces will increase.

Savills also comments, Hanoi is forecasted to continue to attract large FDI sources, being in the top 5 provinces and cities with the highest FDI amount in the country. Besides, a series of free trade agreements to be signed and take effect in the near future will be good springboards for the office segment to recover and develop.

Compared to major cities in the Asia Pacific region, the office market in Hanoi is expected to have a fast recovery after the pandemic, especially in the second half of 2021 until early 2022 when many new projects come into operation and foreign enterprises expand their investment portfolios in Vietnam.

In the coming time, Mr. Binh assesses that the market needs more motivational factors from landlords and tenants, related to preferential terms and policies.

For example, if tenants want more discounts and rent reductions in the long term, they need to make early commitments for a longer lease term. This ensures the rental capacity of the building, while minimizes the risk to the landlords during the rental process.

According to VnExpress